Marcus & Millichap Q1 call on the apartment building investment climate this morning:

- Year over year manufacturing jobs grew 238k. Manufacturing = 20% of GDP but gets no press, where as single family housing < 2% gets all the coverage.

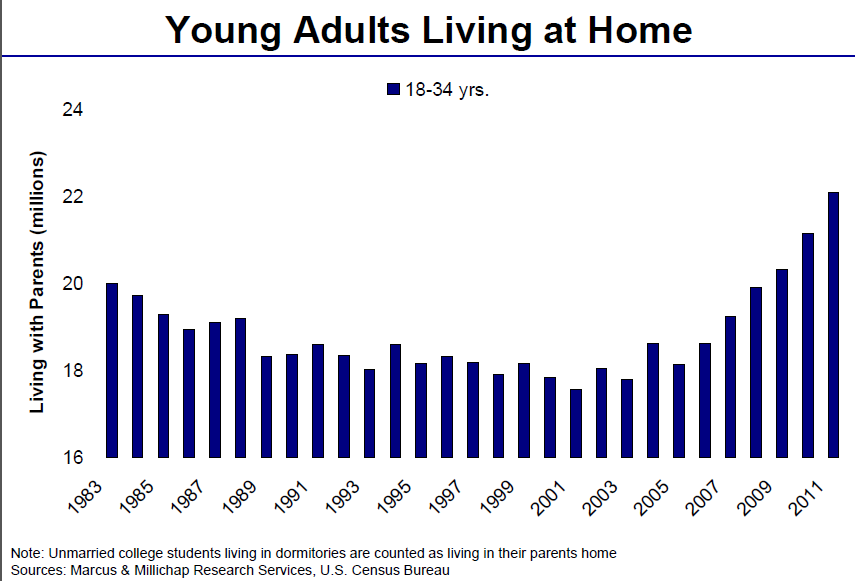

- There is a historic % of 18-34 Y/Os still living ‘with the parents’ but they are also getting a larger proportion of the new jobs. (See chart) Good for apartment building investors as these people typically become renters when they do move out.

- A props in primary (coastal) markets seeing compressed cap rates; most on the call (including me) thought they were a little frothy.

- Nadji feels that if operations and NOI growth keep up, cap rates will remain uncorrelated to interest rates over the short term at least.

- B and C props as well as value add deals really starting to happen, even in secondary markets. ‘Financing Available’ as the car dealers say.

- Tertiary markets still lagging the recovery; pool of lenders is limited mostly to local banks unless there is a particular driver- Contact me about specific markets and opportunities we have uncovered.

- Lending is competitive on rates but conservative on terms though coastal lenders will go to 1.15 DCR. Money is also starting to flow to developers but only with very conservative underwriting and only to experienced players.

- Rates: mid to upper threes on 3 yr loans, up to low fives on 7-10 year terms. Fannie, Freddie still doing the majority of +$5M deals but insurance cos coming back and some CMBS will get done this year.

- Threats to the recovery: The Usual Suspects. Euro, China, unemployment, election, deficit, inflation, mid-East, etc, etc.

Contact me for a copy of the slide deck.

The replay of the webcast is now available at: http://bit.ly/IKtw3t (you may need to register with M&M to view)