Fannie Mae launched their Energy Star program for apartment building investors by releasing their study on utility use. The report, called Transforming Multifamily Housing: Fannie Mae’s Green Initiative and ENERGY STAR for Multifamily (PDF). It’s loaded with great info on reducing energy and water use as well as stats on use broken up by unit, square foot and region. They also talk about their Green Preservation Plus loans which combined with certified Green Buildings they have financed $130 million in loans on as of Q1 2014. But let’s cut to the chase, key findings [Emphasis mine]:

- On average, a 100,000 square foot property spends $125,000 on energy and $33,000 on water annually.

- If this property saved 15% on energy and water costs, it would increase asset value by almost $400,000, at a 6% cap rate.

- The least efficient properties use over three times as much energy and six times as much water per square foot as the most efficient properties.

- When owners paid for all energy costs, median annual energy use was 26% higher than when tenants paid for them.

- High-rise properties use almost 10% more energy per square foot than low-rise properties

- Properties in the West use almost 50% more water per square foot compared to properties in the Northeast.

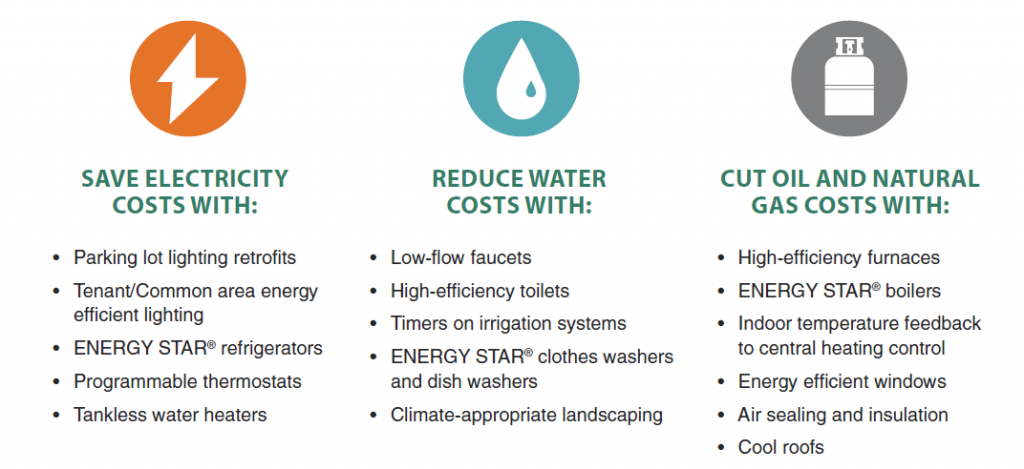

Clearly reducing common area utility costs and getting tenants to pay for their own use are the two of the best ways to improve Net Operating Income (NOI) and they have a nice graphic showing just how to do that:

It’s an interesting finding that buildings in the West use 50% more water than those in the Northeast, I’m thinking that’s due to the fact that there are more suburban properties out West with more pools and landscaped grounds.

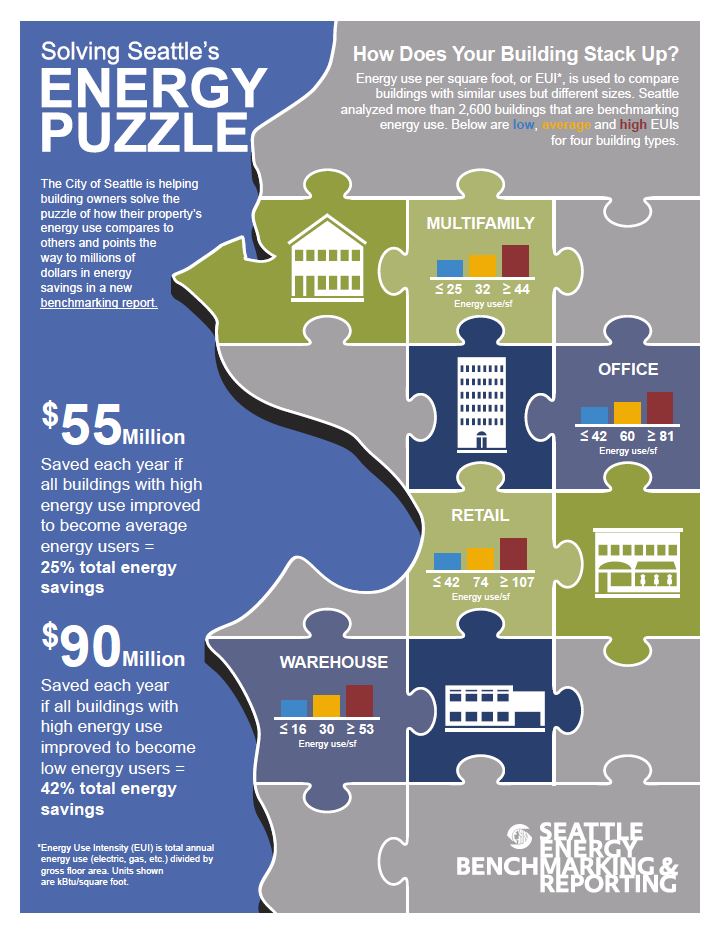

Up to now there has been a number of Green Certification programs for apartment buildings but most were geared to new construction or properties undergoing significant renovation. Also certain municipalities around the country require benchmarking utility use (only six at last count), including my home market of Seattle which requires benchmarking for all commercial and multifamily properties larger than 20,000sf. Now Fannie is providing an easy to use program that can both increase your bottom lime on existing properties as well as open up new sources of better and cheaper financing in the future.

Given that utility costs typically average about 9% of Gross Operating Income (GOI) reducing energy and water costs at your property by even a little bit can raise NOI and cash flow significantly. Since expense ratios at most properties hover around 50%, a ten percent reduction in utility costs means about a 5% bump in NOI and at a 7 cap that represents more than a $14k increase in property value for every thousand dollars of energy and water cost reduction.

The great thing about Fannie’s Energy Star program is that it’s based on using the EPA’s Portfolio Manager online program, which is free. Another advantage is that if you are required to benchmark your property now or in the future, whether it is located in the US or Canada that requirement will most likely be based on using Portfolio Manager.

More on the Energy Star program from Fannie:

“In 2011, Fannie Mae identified that multifamily owners needed a simple way to understand their property’s energy performance but that a single, nationally recognized metric did not exist. Fannie Mae Multifamily Mortgage Business partnered with the U.S. Environmental Protection Agency (EPA) to deliver the 1 – 100 ENERGY STAR® score for multifamily properties. As a result of this partnership, Fannie Mae is proud to announce that the ENERGY STAR score is available for use by the multifamily industry as of September 16, 2014. The 1 – 100 ENERGY STAR score is a product of the Fannie Mae Multifamily Energy and Water Market Research Survey (Survey). In 2012, Fannie Mae surveyed over 1,000 multifamily properties across the U.S. for statistically relevant and comprehensive energy and water information. The EPA used the resulting Survey data to create the ENERGY STAR Score for multifamily.1 Fannie Mae also invested in the Survey to provide owners with greater understanding of a multifamily property’s energy and water performance, trends and metrics.

What is a 1 – 100 ENERGY STAR® Score?

The 1 – 100 ENERGY STAR score for multifamily properties makes it easy to understand a property’s energy performance compared to its peers and to better assess the relative risk of each property. Properties receive a score on a scale of 1 to 100, which accounts for the property’s energy use across fuel types and normalizes for weather, building characteristics, and business activity. This score represents the property’s percentile ranking compared with similar properties. For example, a property with a score of 25 performs better than only 25% of other similar buildings, but a property with a score of 75 performs better than 75% of its peers. In addition, properties with scores of 75 or higher are eligible to earn the ENERGY STAR certification, which is America’s symbol of top energy performance. To learn more about benchmarking in ENERGY STAR Portfolio Manager®, visit: www.energystar.gov/PortfolioManager.”

Note that there are some issues around privacy with certain utility companies when tenants have utility bills in their names. Since that also means they’re already paying them, those costs have been removed from your bottom line which frees you up to focus on reducing common area energy and water use costs.

WegoWise a vendor of utility tracking programs for apartment buildings who claim to have tracked 2.6 million utility bills to date, has introduced the WegoScore, an easy to understand ranking system for evaluating energy and resource use. Wego is essentially competing with the free Portfolio Manager from the EPA mentioned above in the main article. Read about it on Multifamily Executive: New Apartment Energy-Efficiency Rating Introduced http://bit.ly/1sj3993