Was talking about this just last week (again):

As a value guy like you it’s hard to figure out how buying something in the sixes on cap rate works out to be a good deal. But what if the Fed is trapped at the Zero Lower Bound and we are turning Japanese? Their ‘Lost Decade’ is now old enough to graduate with a Master’s degree and we’re following the exact same playbook. I offer last week’s Fed decision as exhibit #1. They would dearly love to raise rates just to prove they can but there’s just thin ice between us and

a recession (look at the trucking and shipping data for instance) and they fear causing the next recession more than being able to do something about it when it does inevitably begin.

Then Bill McBride over at Calculated Risk had a long quote from Janet Yellen’s lecture at Amherst last Thursday that included this section [my emphasis in bold]:

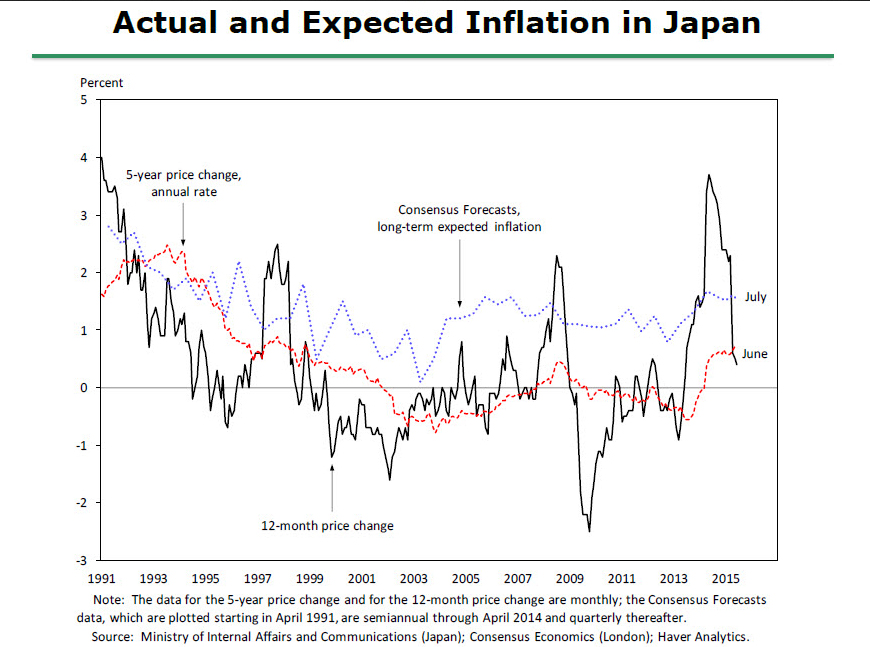

“The economic outlook, of course, is highly uncertain and it is conceivable, for example, that inflation could remain appreciably below our 2 percent target despite the apparent anchoring of inflation expectations. Here, Japan’s recent history may be instructive: As shown in figure 9, survey measures of longer-term expected inflation in that country remained positive and stable even as that country experienced many years of persistent, mild deflation. The explanation for the persistent divergence between actual and expected inflation in Japan is not clear, but I believe that it illustrates a problem faced by all central banks: Economists’ understanding of the dynamics of inflation is far from perfect. Reflecting that limited understanding, the predictions of our models often err, sometimes significantly so.”

See her complete lecture with slides and footnotes here: Inflation Dynamics and Monetary Policy

I started writing about this in December 2013 (and continued here, here, here and here) but this is the first I’ve seen of it from anyone else, let alone the Fed Chair. DEflation if it is mild enough is a lot like mild inflation, it’s there but it doesn’t change your investment approach much. The big threat with deflation is that it can turn into a death spiral where spending and investment is delayed because things are continually getting cheaper which reduces the amount of money available for spending and investment which leads to even more cutbacks, rinse and repeat. In that case we have to turn everything we think we know about money and investment on its head starting with this: debt is bad and cash is king.

Was on a call yesterday with Peter Linneman, very experienced CRE investor and head econ guy at NAI Global who was saying that the slow recovery is due in large part to the Fed’s Zero Interest Rate Policy. Half of the difference between where we are and where we should be in GDP is the lack of new home construction. Much of which he believes is due to the fact that mom & dad, grandpa & grandma are earning zero on their savings and can’t afford to help the kids out with a downpayment (Of course the kids are earning zero on their savings too). If you don’t have the downpayment it doesn’t matter how low interest rates are, you can’t buy a house.

And that is where I think the “Economists’ understanding of the dynamics of inflation is far from perfect. Reflecting that limited understanding, the predictions of our models often err, sometimes significantly so” quote comes into play.

Peter had a very quotable line that sums it all up nicely: “Low rates take the urgency out of the economy.” Right now the cost of doing nothing is pretty low for most people and the lack of growth is proof.

Just to throw another log on the interest rates will stay lower longer than most expect fire, Niels Jensen over at Absolute Return Partners has another set of issues that will hold rates down in his latest piece called The Burden of Low Interest Rates: The certeris paribus enigma (Registration may be required):

– Lower interest rates lead to lower productivity

– Lower interest rates lead to more risk taking

– The big white elephant, aka the pension industry and unfunded liabilities in defined benefit retirement plans.

It’s a good read about a situation that Niels encapsulates as “desperate but not serious”.