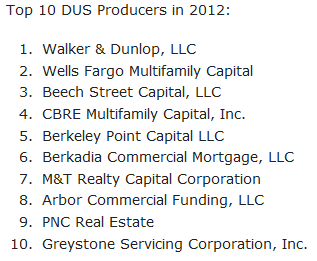

Multifamily Housing News has lists of Fannie Mae’s (here) and Freddie Mac’s (here) top lenders and products for 2012. First Fannie’s:

And Freddie’s:

Top Sellers Nationwide—Volume

- CBRE Capital Markets—$6.2 Billion

- Berkadia Commercial Mortgage—$3.6 Billion

- Wells Fargo Multifamily Capital; Holliday Fenoglio Fowler, L.P.—$2.4 Billion

- Walker & Dunlop, LLC—$2.3 Billion

- NorthMarq Capital, LLC—$1.9 Billion

Top Seller by Freddie Mac Multifamily Region

- Southeast Region: Berkadia Commercial Mortgage, Richmond, Va.

- Central Region: CBRE Capital Markets, Dallas, Texas

- Western Region: CBRE Capital Markets, Newport Beach, Calif.

- Northeast Region: Beech Street Capital, LLC, New York, N.Y.

Fannie grew their small loan volume by 25% to $30 billion and their affordable product by 65% to $3.8 billion last year.

Freddie settled a record $28.8 billion in new multifamily volume last year, comprising 435,000 rental units according to the MHN article.

Wow! Freddie settled $28.8 billion in new multifamily?! That’s crazy!

Bubbley even?

Globe St. reported this on the GSA’s apartment lending in 2012:

“In addition, while the government-sponsored enterprises that include Fannie Mae and Freddie Mac will continue to dominate the financing landscape for multifamily properties in 2013, life companies, national banks, financial institutions and CMBS are expected to further increase their market share in the year ahead, according to Jones Lang LaSalle.

“Plentiful capital, ease of execution and the ‘sweet spot’ in the seven- and 10-year fixed-rate, 80% LTV financings kept the agencies on top in 2012, with Freddie Mac sourcing roughly $29 billion and Fannie Mae topping out around $33 billion,” according to Faron Thompson, international director and leader of Jones Lang LaSalle’s Freddie Mac Program Plus lending business.

As GlobeSt.com previously reported, Fannie Mae and Freddie Mac continue to fuel the market as a source of lending for the exit of development projects, while construction lenders have stepped up at the dirt level, according to JLL.”