Unemployment still 9% and tenants in C props having harder time keeping up with expenses and rising rents. Meanwhile developers will need three years of building to bring market back into balance. See more at: http://bit.ly/wxm5jf

Category: Multifamily Investments

Only 38k Multifamily units added in 2011; demand = 300k+. Grubb & Ellis 2012 Forecast

New development is picking up but is restrained by lack of lender appetite.

Senior housing to see vacancy decline below 10% also.

Via Grubb & Ellis’ 2012 Real Estate Forecast available here: http://bit.ly/xfBnmd

Thanks to Jason Brumm of G&E San Antonio

Extra 100-150bp of risk premium (good!) for Multifamily says Freddie’s Brickman.

AFT: When you look at some of the cap rates on recent transactions, do you feel like the multifamily industry is getting a little overheated in some markets?

Brickman: I do not. I think it is perfectly rational where cap rates are now. The cap rates are driven by financing costs, and what you’re really saying is, can cap rates go up? Of course they can, and if [interest] rates go up significantly, cap rates would likely go up, but it’s not one for one. What you have to look at is [that] the spread of cap rates to Treasuries is actually quite wide.

AFT: It’s probably more than 400 bps now, on average.

Brickman: Exactly, and historically it has not been anywhere near that wide—it’s been more like 250, 300. And so you’ve got a very healthy risk premium to real estate right now, and you’ve got strong growth forecasts. There are very positive influences lining up behind demand and a relatively anemic level of supply. So, I think you can legitimately sign up for pretty healthy rent growth. And that [in] itself justifies a low cap rate even independent of the interest rate.

See the whole interview at: http://bit.ly/xp9VM7

Converting Cap Rates to Earnings Multiples

After a recent speaking engagement I was asked about how and why I use the earnings multiple concept when evaluating apartment investments. It was a great question and so I’m sharing my answer here in this blog post.

As a value investor two of the fundamental questions I always ask is what am I buying and how much do I have to pay for it. With an apartment investment (or really any investment) I am buying current income and the potential for appreciation so the second question comes down to “How many years of earnings do I have to pay for these returns?” The question can be answered by converting the cap rate to an earnings multiple. The Cap Rate is the return in current income on an apartment investment you could expect if you paid all cash. To convert a Cap Rate into a Earnings Multiple use the formula: Continue reading Converting Cap Rates to Earnings Multiples

Why are Cap Rate explanations so complicated?

If you listen to any conversation about commercial real estate (CRE) within a minute the subject of cap rates will come up. Those who are just beginning to explore CRE are often thrown off by what one is and how it is calculated. A cap rate is really a simple thing that is often made overly complicated by the way it is explained. Let’s walk through what a cap rate is and then we’ll look at how they are used so that the next time the conversation turns to CRE you’ll be right there in sixty seconds when they get to cap rates.

A Capitalization Rate or Cap Rate for short is simply what you would earn on a property if you Continue reading Why are Cap Rate explanations so complicated?

Apartment Buildings are the classic Value Investment

With today’s stock and bond markets overrun by insiders and the volume of options, futures and other derivatives dwarfing actual investment in good companies while driving wild swings in their prices what is a traditional value investor to do? What about the accounting trickery that happens when CEOs raid their own companies for the short term results their huge bonuses are based on? Should you shrug your shoulders and be patient, very patient hoping eventually value will be recognized? What kind of income will you live on while you are being so patient? With interest rates so low and the Fed trapped into keeping them that way how can you earn decent current income without taking unreasonable or unknowable risks?

There is an alternative for conservative value investors: Apartment buildings.

- What if you could find good value stocks in a market where the price was dictated by the financial results, not market ‘sentiment’, momentum traders, short sellers, high frequency trading programs or what a butterfly did in Shanghai?

- What if you could find good value stocks in a market where the cycles were observable and understandable?

- What if your favorite value stocks paid annual cash dividends of 7, 8, 9% or higher while at the same time increasing their equity like clockwork?

- What if you could walk into the boardroom of your favorite value stock and dictate that they improve their performance? What if you could fire boardmembers who didn’t perform?

- What if you could buy a second stock with funds from your first stock without having to sell it or pay taxes on the capital gain?

- Plus Inflation Protection: What if the dividend went up when inflation did? Continue reading Apartment Buildings are the classic Value Investment

Why We Like Apartments- Owning them that is.

Recently I’ve been working with several new clients who are conservative investors looking for better returns than CDs and Treasuries but aren’t interested in taking on the volatile market risk of stocks, bonds and derivatives. I was explaining why apartment investments make sense and there are quite a few reasons but the biggest one is how the math of an apartment building investment works. In this post I’d like to share that with you in case you’re also looking for conservative income producing investments with inflation protection and upside potential.

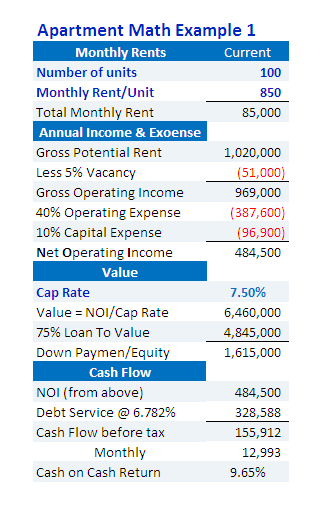

Here’s the numbers on a typical apartment investment:

In this example is a 100 unit building with 850 per month per unit average rents which is purchased with a down payment of 25% and a 30 year loan for the balance at 5.5% interest. Vacancy is 5% of Gross Potential Rent, expenses total 50% of Gross Operating Income and a cap rate of 7.5% is used. Today in some markets cap rates are higher (buildings less expensive) and in a few others cap rates are lower (buildings more expensive).

Apartment Buildings are valued on the income they produce. (This post is about properties larger than 4 units, smaller properties are valued more similarly to single family homes.) There are several ways to calculate the value based on the income but the most common is the capitalization rate, or cap rate for short. The cap rate is the percent of the property value that the Net Operating Income (NOI) represents: Continue reading Why We Like Apartments- Owning them that is.

The Apartment Building Investment Triple Opportunity Is Right Now

For value investors, Demand, Supply and the Cost of Acquisition are the three factors affecting the apartment building investment decision and all are saying the time to buy is now. There is a tidal wave of new renters coming into the market and there has been little apartment construction to meet this growing demand. Outside of the gateway cities the prices of existing apartment buildings remain below the cost of building new. Fixed rate financing is available for apartment buildings at rates lower than we will see again for years if not decades.

“The multifamily sector is probably the only commercial real estate sector that has very positive fundamentals behind it,” said Jeffrey Baker, managing director at Savills LLC, a real estate investment bank that raises capital for multifamily owners and developers. “You’ve got a demographic that is producing more households that want to rent an apartment. You’ve got virtually no new supply that’s been added over the last several years.”1 Continue reading The Apartment Building Investment Triple Opportunity Is Right Now

Top Ten Reasons To Own Apartments Now

I believe that apartment building investment should be a core holding for every successful conservative investor. Briefly here are the top ten reasons for low risk investors:

1. Monthly Income. Properly acquired apartments generate monthly checks in 6-8% or higher annual cash on cash returns.

2. Straight forward, conservative investment strategy. Buying existing apartment buildings with good due diligence means that you know what you’re getting going into the investment. Apartments are not subject to sudden changes in investor sentiment and/or valuations.

3. The numbers determine the value. Apartments are valued based on rents less expenses (Net Operating Income) and increases in rents can go straight to the bottom line increasing the value.

4. Inflation protection. Rents rise with inflation and with 12 month leases every year there is the opportunity to adjust rates. With fixed rate financing your income goes up while your biggest cost stays the same. Continue reading Top Ten Reasons To Own Apartments Now

It’s painful, it’s ugly, it’s what a real estate bottom feels like.

Does the market feel like you are in the opening sequence from Terminator II? Are you fighting amidst the wreckage of the previous boom? Surrounded by foreclosures, scarce money, economic gloom and doom? Real estate going into nuclear winter? That’s what market bottoms feel like and as investors we need to get comfortable with that feeling because this is our time to make solid, reasoned investments that produce good results on improving fundamentals. Conditions like this create the opportunities for savvy investors who were patient through the bubble and have waited for the speculative, greater fool market to come to its inevitable end.

Many great real estate investors got their start in rough times like Sam Zell of Equity Residential for instance. He started out buying properties from distressed owners in the late sixties. Tom Barrack of Colony Capital waded through the carnage of the S&L meltdown to buy properties at a discount. Barry Sternlicht of Starwood Capital also started in the wake of the S&L crisis buying multifamily properties. What will your story be? It’s time get to work and seize the opportunities. Put on your hardhat though because it’s about to start raining real estate, and while not every distressed property is worth pursuing if you stick to your niche and learn your market good deals will surface. Continue reading It’s painful, it’s ugly, it’s what a real estate bottom feels like.