Category: Commercial Real Estate

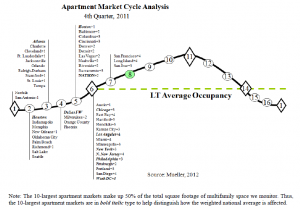

Where is your apartment market in the cycle? Latest Multifamily Market Cycle Charts now posted via Glenn Mueller, PhD.

Canadian office, industrial and retail Real Etate on fire too. Not just multifamily.

see the CNW article here: Strong performance in Canadian real estate continues

When long time contrarians flip is that confirmation of a market top? What about in multifamily?

Read this week that well known stock market perma-bears have gone bullish and that struck a nerve in my contrarian’s contrarian heart. This morning I read a post on the Joseph Bernard Investment Real Estate blog that really got my attention. Here’s what stopped me in my tracks:

In three decades working in and studying multifamily, Johnsey, president of Dallas-based research firm Axiometrics, has developed a bias toward an outlier’s view of what’s happening and what’s coming next. This time, though, it’s different. Strangely, he’s finding no counterpoint position to argue.

“Everything is just ripe for a robust apartment market,” Johnsey says. “I’m always looking for problems. But these numbers are just some of the strongest I’ve seen.”

Johnsey has company aplenty. Market researchers, Wall Street analysts, REIT executives, big multifamily players, and small alike can scarcely quell optimism over practically a sure bet for a bountiful 2012. [Emphasis mine]

Regular readers and students of the financial collapse will instantly recognize the first highlight as echoing the title of probably the best book ever written on the subject, “This Time Is Different: Eight Centuries of Financial Folly”. Authors Rogoff and Reinhart have researched and written (exhaustively) about how many times that sentiment has proven exactly wrong. If you haven’t read it, check it out on Amazon by clicking on the book image in the ‘Learning From History’ section on the right of this page.

Granted the rest of the article goes on to lay out the great fundamentals the national apartment market is currently enjoying and further that short of institutional grade properties in core markets multifamily is a very local business (and properties are more reasonably priced). But still…

What are you seeing in your market?

Amazon is building a 3M square-foot campus of office towers in Seattle

More jobs = more renters, good for multifamily. See the piece here: Amazon is building a 3m campus of towers

Canadian Multifamily Bubble? Sadly the US can watch from hindsight.

Interesting peek at multifamily in Toronto and Vancouver, worth a read to see how many rationalizations you recognize (or have uttered yourself). Nice quote: “If builders stopped building today, there’s five years worth of supply that is about to be delivered, relative to what normal population growth is.” Sound familiar? They’re even starting to do NINJA liar’s loans.

Toronto home and condo prices are amazingly high, the average price for a detached home C$543,993; for condos it’s ‘only’ C$343,835. In Vancouver the Continue reading Canadian Multifamily Bubble? Sadly the US can watch from hindsight.

Distressed Commercial RE Continues to Ebb. What about Multifamily?

Distressed commercial real estate is slowly climbing down from the heights it reached in October 2010, of $191.5B. Forthcoming figures by Delta Associates and Real Capital Analytics will show that distressed commercial real estate in the US totaled $166.9B in January 2012, down $4.7B since October 2011… attributed to a mix of circumstances, starting with extend and pretend…

See the whole article here: Globe St.com: Distressed CRE Continues to Ebb

Latest NMHC Multifamily Survey: Tightening Markets, More Sales, Debt and Equity Financing Becoming More Available.

See the report here: NMHC Quarterly Survey of Apartment Market Conditions

Multifamily Buildings to Lead U.S. Construction Gains-

Feb. 13 (Bloomberg) — Construction of multifamily units will lead the U.S. building industry again this year, allowing housing to contribute to growth for the first time in seven years, according to economists Michelle Meyer and Celia Chen.

Work will begin on about 260k apartment buildings and townhouse developments in 2012, up 45% from last year and the most since ’08, according to Meyer, a senior economist at Bank of America Corp. in New York. Chen, an economist at Moody’s projects a record 74% jump to 310k.

Homeownership rates, which have declined to the lowest levels since ’98, may keep dropping as the foreclosure crisis turns more Americans into renters. In addition, household formation will probably accelerate as an improving economy and growing employment embolden more people to stop sharing residences and strike out on their own.

“Given the ongoing shift from owning to renting, there is increasing demand for multifamily construction,” Meyer said in an interview. See the whole Bloomberg piece here: Foreclosures are transitioning people out of ownership

Seattle Area Multifamily Report now posted on Reis Reports- Caps flat, rents mixed but vacancy down

See the report here: http://bit.ly/xm8uUG