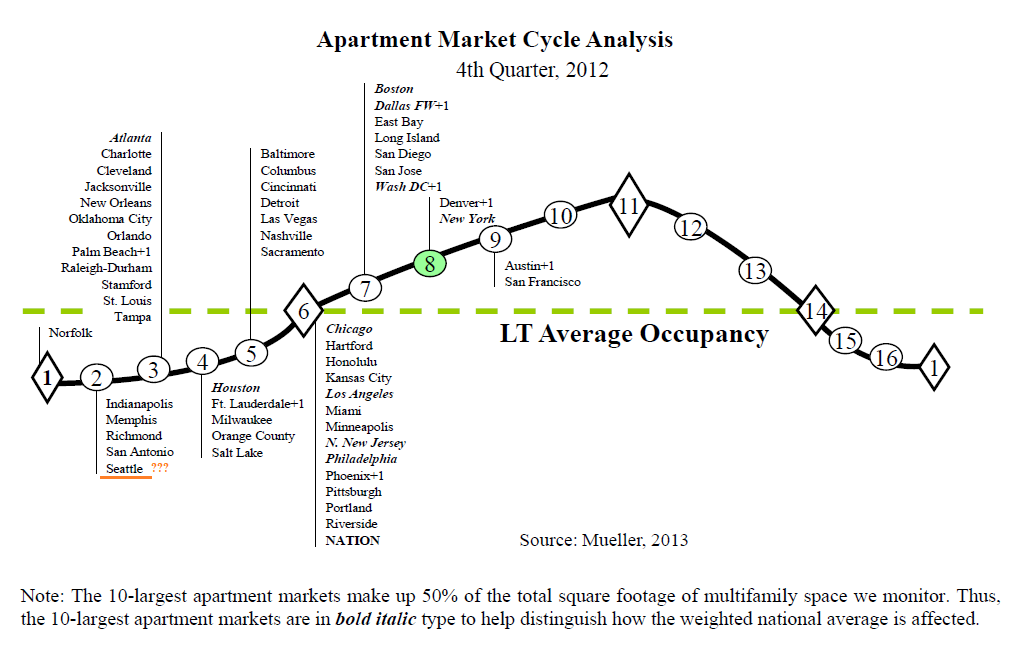

We all know that jobs are a critical driver of the apartment building investment cycle and so we dutifully follow along with the talking heads when the unemployment number is estimated, released and then its potent debated. But Mike Scott over at Dupre+Scott points out in a piece posted Friday that apartment building investors should be following employment, not unemployment. Specifically he recommends measuring how many jobs it takes to create demand for one apartment unit. Currently in King County (where Seattle is the county seat and where Dupre+Scott is located) it takes about 8 jobs to do that:

The formula is simple: Net new jobs / apartment units absorbed. And if you’re an multifamily investor in the tri-county area (King, Pierce and Snohomish in WA State) that Dupre+Scott provides apartment investment research for, they’d be happy to supply you this information http://www.duprescott.com.

Looking at the chart we can see that while currently it takes about eight jobs to fill one unit it wasn’t always so and in fact the twenty year average is closer to nine. Mike explains Continue reading More important than unemployment for apartment building investors?