See the report here: NMHC Quarterly Survey of Apartment Market Conditions

Month: February 2012

Multifamily Marketing; What can you learn from the big players?

“Not all residents want the same thing,” Conway says. “Listening to what our consumers want and wrapping them in a brand is going to help us grow.” AvalonBay hopes to attract younger consumers to its metropolitan “AVA” buildings… designed to be more youthful than other high-end AvalonBay buildings because they’re targeted to Gen Y residents, many of whom live with roommates in smaller, urban-style apartments.

Are your properties targeting specific demographics? Could you attract more tenants by marketing to a specific lifestyle? See the whole MFE article here: AvalonBay Launches Brands for Gen Yers, Suburbanites

Multifamily Buildings to Lead U.S. Construction Gains-

Feb. 13 (Bloomberg) — Construction of multifamily units will lead the U.S. building industry again this year, allowing housing to contribute to growth for the first time in seven years, according to economists Michelle Meyer and Celia Chen.

Work will begin on about 260k apartment buildings and townhouse developments in 2012, up 45% from last year and the most since ’08, according to Meyer, a senior economist at Bank of America Corp. in New York. Chen, an economist at Moody’s projects a record 74% jump to 310k.

Homeownership rates, which have declined to the lowest levels since ’98, may keep dropping as the foreclosure crisis turns more Americans into renters. In addition, household formation will probably accelerate as an improving economy and growing employment embolden more people to stop sharing residences and strike out on their own.

“Given the ongoing shift from owning to renting, there is increasing demand for multifamily construction,” Meyer said in an interview. See the whole Bloomberg piece here: Foreclosures are transitioning people out of ownership

Multifamily Sales Close Out 2011 on the Rise, Lead by Garden Style.

A recent report from New York–based commercial real estate research firm Real Capital Analytics (RCA) reveals that apartment sales figures closed out 2011 on a positive note. The firm’s “2011 Year in Review” report shows that the fourth quarter of 2011 netted $16.6 billion in sales, the highest quarterly volume racked up since 2007. This marks a 16 percent increase from the previous quarter and a 24 percent bump from fourth-quarter apartment sales in 2010. Among the more optimistic data revealed in the report was the rebound of garden-sector sales.

Garden properties ended up 47 percent ahead of the 2010 figures, and it appears that the sales momentum experienced in the fourth quarter will carry over into the first quarter this year. “Given the stable cap rate environment for garden properties, compared to sinking caps in mid-/high-rise, that trend is likely to continue in 2012,” projects Thypin.

See the whole AHF article here: Apartment Sales Close Out 2011 on the Rise

Chess, Economics and The Rocketing Swiss Franc: Lunch with Ken Rogoff. Great FT article via The Big Picture Blog

Rogoff, with his co-author, Carmen Reinhart, has written the definitive history of financial crises over the centuries: “This Time is Different”

On Govt. debt: The key, Rogoff argues, is to ignore everything that governments say and instead to concentrate on the incentives that drive their behavior.

Read the whole article here: Lunch with the FT

Why it’s good news that more Americans are renting rather than buying homes. Via Slate. Good for #Multifamily

Exec Sum:

The American economy is making a significant shift from buying to renting, and that may ultimately be good news. According to a USA Today analysis of Census data released this weekend, since 2006, the number of households that rent has grown by about 700,000 a year, while the number of households that own has fallen by about 200,000 a year.

[R]enting is better than owning for many Americans. Indeed, dozens of recent studies have shown that, excepting the go-go bubble years, houses tend not to make very good investments at all: A prospective homebuyer would have made more money taking her down payment, parking it in inflation-adjusted Treasury bonds, and renting.

But it is conclusive: Not everyone should own a home. The recession has helped erode the stigma against renting, with about 70 percent of Americans now admitting that it has advantages over buying a house. If people are making unsentimental decisions about whether homeownership is really worth it for them, that is at least one small benefit of the housing bubble bursting.

See the whole article with links to reports and surveys here: The Rent Isn’t Too Damn High

Seattle Area Multifamily Report now posted on Reis Reports- Caps flat, rents mixed but vacancy down

See the report here: http://bit.ly/xm8uUG

Connecting with the Fluid Consumer in 2012, good Critical Mass Slideshare on Barry Ritholtz’s blog

Fluid Consumers:

- Ebb and Flow At Their Leisure

- Seek Their Own Level

- Follow The Path Of Least Resistance

- Erode The Best Marketing Intentions

- Collectively, Are A Force Of Nature

- They Live In The Here And Now

- They Seek Answers

- They Are Plugged In

- …

Check it out here: http://bit.ly/x2QkrR

NY AG Schneiderman and OWS finally convince Obama to go after banksters. Via TBP Blog

Elected attorney general in November 2010, Schneiderman discovered upon taking office that the Obama administration was avidly promoting a proposed settlement among five mega-lenders… In return.. the feds and the state AGs would grant the banks immunity for not just any further robo-signing misdeeds but for all illegal conduct that had led to the 2008 collapse… the banks would be free and clear of any state or federal prosecution for these offenses. Indeed, with no agency of government able to bring legal action, there would be no serious investigation of whether and how the banks broke the law.

“We have to get accountability,” Schneiderman told me this week. “We have to get substantial relief for homeowners and investors. And we have to get the story told clearly and factually, so the history doesn’t get rewritten. If you listen to the presidential debates, you hear the same supply-side and deregulatory nonsense that got us into this crisis. If we don’t uncover the facts and put them out there, it will happen again.”

See the whole article here: The man who shaped Obama’s drive to hold banks accountable

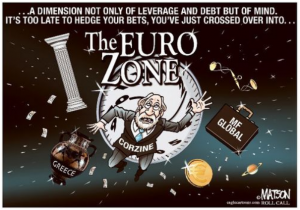

Zero Bound Interest Rates, The Zirp Dimension, Stagflation and #Multifamily

Zero interest rates and apartment building investment.

First my condolences to Bill Gross on the loss of his brother-in-law. Reading his piece in PIMCO’s latest Investment Outlook it is clear that the world’s biggest bond manager is running out of places to generate returns for their investors and by extension this applies to all income investors, especially retired people trying to live on interest income. For those would like to retire soon you may have to delay that decision for “an extended period’ as Edward Harrison over at Credit Writedowns put it in Permanent Zero and Personal Interest Income.

Gross’ points out that the Fed’s zero interest rate policy (ZIRP) which they have just announced to maintain through 2014 and their defacto though opaque continuation of quantitative easing (QE2.5 as he tweeted it) threaten to take us into another dimension where their policies have the opposite effect of their intentions.

“Much like the laws of physics change from the world of Newtonian large objects to the world of quantum Einsteinian dynamics, so too might low interest rates at the zero-bound reorient previously held models that justified the stimulative effects of lower and lower yields on asset prices and the real economy.” – Bill Gross

His bullet points:

- Recent central bank behavior, including that of the U.S. Fed, provides assurances that short and intermediate yields will not change, and therefore bond prices are not likely threatened on the downside.

- Most short to intermediate Treasury yields are dangerously close to the zero-bound which imply limited potential room, if any, for price appreciation.

- We can’t put $100 trillion of credit in a system-wide mattress, but we can move in that direction by delevering and refusing to extend maturities and duration.

For more views on this and Europe too see also Entering the Debt Dimension from Phil’s Picks on the Phil’s Stock World Blog.

What does this mean for Multifamily?

The Zirp Dimension leads to Stagflation where economic growth remains anemic yet prices on essential Continue reading Zero Bound Interest Rates, The Zirp Dimension, Stagflation and #Multifamily