Gallows humor for sure. The article is the best explanation of Europe’s predicament in layman’s terms I’ve read. See the article here: The End of Europe?

Month: January 2012

Hoisington Quarterly Review and Outlook “Recession in 2012”.

Housington Investment Management runs about $4B in fixed income institutional money so they pay very close attention to the economy, government as well as fiscal and monetary policy. In fact Dr. Lacy Hunt, co-author of the report, is one of Mauldin’s most highly regarded economists. Here’s the exec sum (see the whole article at http://bit.ly/wM9DIY):

High Debt Leads to Recession

As the U.S. economy enters 2012, the gross government debt to GDP ratio stands near 100% (Chart 1). Nominal GDP in the fourth quarter was an estimated $15.3 trillion, approximately equal to debt outstanding by the federal government. In an exhaustive historical study of high debt level economies around the world, (National Bureau of Economic Research Working Paper No. 15639 of January 2010, Growth in the Time of Debt), Professors Kenneth Rogoff and Carmen Reinhart [Again with those two!] econometrically demonstrated that when a country’s gross government debt rises above 90% of GDP, “the median growth rates fall by one percent, and Continue reading Hoisington Quarterly Review and Outlook “Recession in 2012”.

Is a Gold Standard the Answer to Our Monetary Crack-Up?

My brother Tom shared an article from the Cato Institute entitled: “Why Gold-Defined Money Is the Answer to Our Monetary Crack-Up”.

I agree with the writer in theory but as Yogi Berra said: In theory, there is no difference between theory and practice. In practice, there is. A couple points:

With a fixed currency like a gold standard innovation and value creation that grows the economy will be constrained and what growth does occur will cause prices to fall, hurting the producers of goods and limiting real returns to their investors. There has to be some mechanism to grow money supply at the approximate rate of real growth in the economy.

The real problems we’re facing around the world are from excess leverage and at the end of every debt binge the unwinding happens in three ways. Debt creation can be reduced and austerity can be imposed to make room for Continue reading Is a Gold Standard the Answer to Our Monetary Crack-Up?

DC Multifamily sales surge to $4.7B in 2011, up 1.1B from 2010.

By Daniel J. Sernovitz Staff Reporter – Washington Business Journal

I believe this quote from the article reflects an important trend in multifamily, indeed all residential development, re-development and infill: “People are paying a premium to be within a one-block radius of a Metro station, and properties within walking distance of Metro stations continue to be a strong lure for investors,”…

One thing the article doesn’t cover is where prices are vis-a-vis replacement cost… makes me wonder where they are in their apartment market cycle-

See the whole article here: DC Multifamily Sales Surge in 2011

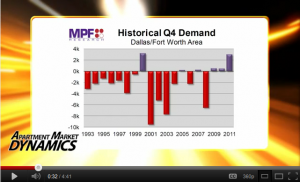

Record Rent Growth & Q4 Demand in Dallas/Fort Worth Multifamily Markets: Video

Year-over-year rent growth reached a two-decade high in the Dallas/Fort Worth apartment market. And demand in 4th quarter — typically a slow leasing period — was unusually strong.Record Multifamily Rent Growth in DFW

Leading Indicators and the Risk of a Blindside Recession. In-depth on economic indicators from John Hussman

Over the past few weeks, investors used to setting their economic expectations based on a “stream of anecdotes” approach have seen their economic views evolve roughly as follows:

“After a brief ‘scare’ during the third quarter, economic reports have come in better than expectations for weeks – a sign that the economy is on a gradual but predictable growth path; Purchasing managers reports out of China and Europe have firmed, and the U.S. Purchasing Managers Indices have advanced, albeit in the low 50’s, but confirming a favorable positive trend, and indicating that the U.S. is strong enough to pull the global economy back to a growth path, or at least sidestep any downturn…”

“Unfortunately, in all of these cases, the inference being drawn from these data points is not supported by the data set of economic evidence that is presently available, which is instead historically associated with a much more difficult outcome. Specifically, the data set continues to imply a nearly immediate global economic downturn… Frankly, I’ll be surprised if the U.S. gets through the first quarter without a downturn.” (Underlining mine)

Definitely worth a careful read: http://bit.ly/ArTDyK John Hussman is a value investor and a serious student of the economy, we may not always agree with him but we should not dismiss his research.

Apartment Building Investments still attractive for 2012 says Gary Shilling.

Gary likes small luxuries, health care and apartments among investment sectors.

On Apartments: “last year our index of apartment REITs gained 14%. This year we look for further gains in rental apartment prices and securities related to them. Rental apartments will continue to benefit from the separation that Americans are beginning to make between their abodes and their investments. The two used to be combined in owner-occupied houses back when owners believed house prices never fall, and they hadn’t since the 1930s. So they bought the biggest homes they could finance. The collapse in house prices has shown them otherwise. A further 20% weakness in the prices of single-family houses due to the depressing effects of excess inventories will add fat to the fire.

It will take a surprisingly small shift in housing patterns to make a big difference in the demand for and construction of rental apartments. Today, there are 114 million housing units in the U.S., of which 38 million are rented. If only one percent of total households decided to move to rented units, the demand for rentals would increase by over one million, most of which would need to be newly built apartments, after current vacancies are absorbed. This is a big number compared to new apartment starts of 333,000 on average over the past 10 years. To put it another way, each 1% decline in the homeownership rate increases rentals by more than one million, to the extent those ex-homeowners don’t double up.

Rental apartments will also appeal to the growing number of postwar babies as they retire, downsize and want less responsibility and more leisure time.

See all of Gary’s picks in this edition of John Mauldin’s Outside The Box

Multifamily’s Future in 2012

Amid limited supply and demand edging up, market conditions for the multifamily sector should be favorable in 2012 but Europe is a wildcard for the economy. Demographics support demand says Ron Witten, president of Witten Advisors; “The data suggests that somewhere over 60 percent of the jobs created in 2010 and 2011 have been 20- to 34-year-olds going to work. That’s very good news for the apartment sector.” See more at: http://bit.ly/Aq73Sf

Fannie, Freddie expected to remain dominant Multifamily lenders over next 2-5 years. Video

… and other apartment market predictions for 2012 from industry leaders. See video here: Fannie, Freddie to remain dominant Multifamily lenders next 2-5 years

Feds to turn foreclosures into rentals, Good for Multifamily?

(CNNMoney) — Federal officials hope to launch a pilot program in early 2012 to convert government-owned foreclosures into rental properties.

The program, which was cited by Federal Reserve Chairman Ben Bernanke last week as one way to address the housing crisis, would sell foreclosed homes now owned by Fannie Mae and Freddie Mac to investors in bulk. The properties would then be converted into rentals.